Descriptions of the features

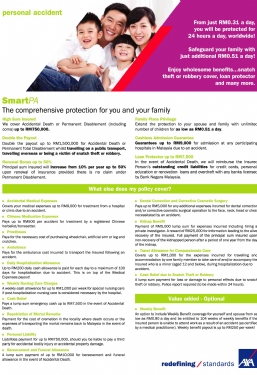

Our SmartPA offers you and your loved ones comprehensive coverage that provides 24-hour protection around the world.

High Sum Insured

We cover Accidental Death or Permanent Disablement (including coma) up to RM750,000.

Double the Payout

Double the payout up to RM1,500,000 for Accidental Death or Permanent Total Disablement whilst travelling on a public transport, travelling overseas or being a victim of snatch theft or robbery.

Renewal Bonus up to 50%

Principal sum insured will increase from 10% per year up to 50% upon renewal of insurance provided there is no claim under Permanent Disablement.

Family Plans Privilege

Extend the protection to your spouse and family with unlimited number of children for as low as RM0.51 a day.

Cashless Admission Guarantee

Guarantees up to RM9,000 for admission at any participating hospitals in Malaysia due to an accident.

Loan Protector up to RM7,500

In the event of Accidental Death, we will reimburse the Insured Person’s outstanding credit liabilities for credit cards, personal loan, overdraft, education, housing, car or renovation loans with any banks licensed by Bank Negara Malaysia.

Accidental Medical Expenses

Covers your medical expenses up to RM9,000 for treatment from a hospital or clinic due to an accident.

Alternative Medication Treatment

Pays up to RM500 per accident for treatment by a registered traditional medicine practitioner, osteopath, chiropractor, herbalist and/or bonesetter.

Prostheses

Pays for the necessary cost of purchasing wheelchair, artificial arm or leg and crutches.

Ambulance

Pays for the ambulance cost incurred to transport the Insured following an accident.

Daily Hospitalization Allowance

Up to RM200 daily cash allowance is paid for each day to a maximum of 100 days for hospitalisation due to accident. This is on top of the Medical Expenses payout!

Weekly Nursing Care Charges

A weekly cash allowance for up to RM1,000 per week for special nursing care if post-hospitalization nursing care is considered necessary by the hospital.

Cash Relief

Pays lump sum emergency cash up to RM7,500 in the event of Accidental Death.

Repatriation Expenses

Payment for the cost of cremation in the locality where death occurs or the expenses of transporting the mortal remains back to Malaysia in the event of death.

Personal Liability

Liabilities payment for up to RM750,000, should you be liable to pay a third party for accidental bodily injury or accidental property damage.

Bereavement/ Funeral Allowance

A lump sum payment of up to RM 10,000 for bereavement and funeral allowance in the event of Accidental Death.

Dental and Corrective Surgery

Pays up to RM5,000 for any additional expenses incurred for dental correction and/or corrective cosmetic surgical operation to the face, neck, head or chest necessitated by an accident.

Kidnap Benefit

Payment of RM5,000 lump sum for expenses incurred including hiring a private investigator. A reward of RM25,000 for information leading to the alive recovery of the Insured. Full payment of the principal sum insured upon non-recovery of the kidnapped person after a period of one year from the day of the kidnap.

Compassionate Care Allowance

Covers up to RM1,000 for the expenses incurred for travelling and accommodation by one family member to take care of and/or accompany the Insured who is a minor (aged 12 and below), during hospitalization due to accident.

Snatch Theft or Robbery

A lump sum payment for loss or damage to personal effects due to snatch theft or robbery. Police report required (to be made within 24 hours).

Value added - Optional

Temporary Total Disablement

An option to include Weekly Benefit coverage for yourself and spouse and be entitled to 104 weeks of weekly benefits if the insured person is unable to attend work as a result of an accident (as certified by a medical practitioner). Weekly benefit payout is up to RM250 per week!

Hospital Admission Hotline

1300-80-0020

Cashless Admission Due To Accident (Panel Hospitals Only)

Just present your SmartPA Card for cashless, hassle-free admission. If you do not have the card with you at the time of admission, call the hotline above and inform the operator your name and identity card number.

Table of benefits

| Benefits |

Plan 1 |

Plan 2 |

Plan 3 |

Plan 4 |

Plan 5 |

Plan 6 |

| Accidental Death |

RM50,000 |

RM100,000 |

RM200,000 |

RM300,000 |

RM500,000 |

RM750,000 |

| Accidental Permanent Disablement |

RM50,000 |

RM100,000 |

RM200,000 |

RM300,000 |

RM500,000 |

RM750,000 |

| Double Indemnity |

RM100,000 |

RM200,000 |

RM400,000 |

RM600,000 |

RM1,000,000 |

RM1,500,000 |

| Renewal Bonus |

10% per year up to 50% of principal sum insured |

|

Accidental Medical Expenses

a) Medical Expenses |

RM3,000 |

RM4,000 |

RM5,000 |

RM6,000 |

RM7,000 |

RM9,000 |

|

b) Alternative Medical Treatment

(Maximum RM50/ Consultation/ Day) |

RM500 per accident |

| Prostheses |

max RM1,000 per accident |

| Local Ambulance Fees |

RM500 |

| Daily Hospitalization Allowance (maximum 100 days) |

RM50/day |

RM75/day |

RM100/day |

RM125/day |

RM150/day |

RM200/day |

| Weekly Nursing Care Charges (maximum 4 weeks) |

RM500/week |

RM750/week |

RM1,000 per week, RM4,000 per accident |

| Cash Relief |

RM2,000 |

RM3,000 |

RM5,000 |

RM5,000 |

RM7,500 |

RM7,500 |

| Repatriation Expenses (up to) |

RM10,000 |

| Personal Liability |

RM50,000 |

RM100,000 |

RM200,000 |

RM300,000 |

RM500,000 |

RM750,000 |

| Bereavement/ funeral Allowance |

RM5,000 |

RM10,000 |

| Dental and Corrective Surgery |

RM5,000 |

|

Kidnap Benefits

a) Lump sum payment |

RM5,000 |

| b) Reward for information leading to alive recovery of insured person |

RM25,000 |

| c) Insured person not recovered after 1 year from date of Kidnap |

RM50,000 |

RM100,000 |

RM200,000 |

RM300,000 |

RM500,000 |

RM750,000 |

| Compassionate Care Allowance |

RM200 per week up to RM1000 |

| Snatch Theft or Robbery |

RM300 |

| Cashless Admission Guarantee |

RM3,000 |

RM4,000 |

RM5,000 |

RM6,000 |

RM7,000 |

RM9,000 |

| Loan Protector |

RM2,000 |

RM3,000 |

RM5,000 |

RM5,000 |

RM7,500 |

RM7,500 |

|

Optional Benefit |

| Class 1 & 2 - Temporary Total Disablement (Weekly Benefit up to 104 weeks) |

RM50 |

RM75 |

RM125 |

RM150 |

RM200 |

RM250 |

| Class 3 - Temporary Total Disablement (Weekly benefit up to 104 weeks) |

RM50 |

RM50 |

RM50 |

N/A |

N/A |

N/A |

Note:

1. Eligible age is any person aged from 18 to 65 years old, renewable up to 75 years.

2. Eligible age for children is from 1 to 18 years of age (or up to 23 years for full-time students).

3. Children are covered 15% for Death and Disability benefits and 100% for other benefits.

4. Only legal children can be insured (irrespective of number of children).

5. Family Limits apply. Kindly refer to policy wording for full details.

6. For the premium table, please refer to Section C Insurance Details in the proposal form.

If you would like to know more, please send an Enquiry or Contact Us.

Policy Wording

FAQ

Who is eligible to join?

Any person ages 18 to 65 years old is eligible to join. The renewal age is up to 75 years.

Are there exclusions?

Some of the standard exclusions are: venereal disease; HIV; AIDS; ARC; any unlawful act; wilful exposure to danger; suicide; self-implicated injury; pre-existing physical or mental defect, or infirmity; illness; cosmetic surgery; pregnancy; childbirth; military; police or fire duties; war; invasion; rebellion; ionising radiation or contamination by radioactivity from any irradiated nuclear fuel/ component or any radioactive toxic explosive, participation in dangerous sports - skin diving, parachuting, winter sports; underwater activities requiring the use of breathing apparatus; steeple chasing; big game hunting; professional sports and racing.

Are there any occupational exclusions?

These are divers; police; naval; air force army/military; law enforcement officers; aircraft testers; pilots or crew; seamen and sea fishermen; racing drivers; jockeys; oil rig workers; sawyers and timber workers; firemen; steeplejacks; stevedores; persons engaged in demolition of buildings; persons engaged in ambulance services; woodworking machinists; explosive handlers; persons engaged in underground tunneling and mining; and professional sports persons. Please consult your insurance advisor at AXA Affin General Insurance Berhad for more details.

-2.jpg)

Back

Back

-1.jpg)