Golden Protection PA

Underwritten by Asia Specialty Limited

Powered By Easicirle.

Education Supported By MMI

Please follow this link....

MMI Services

FREE View, FREE Membership....., NO hidden T&C......

MMI Global Assist Line +6011-12239838 Whatsapp, Line, Viber.

PERSONAL ACCIDENT INSURANCE

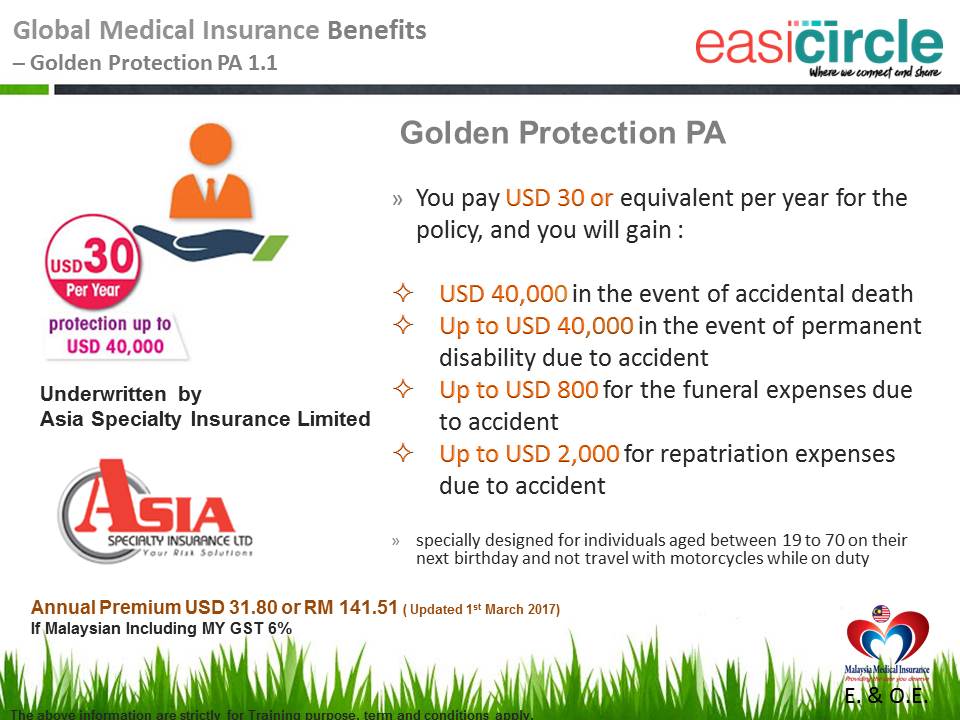

USD 30 per year only for a protection of up to USD 40,000

Underwritten by Asia Specialty Insurance Limited, specially designed for all classes of occupation, this policy provides compensation up to USD 40,000 in the event of accidental death or permanent disablement due to accident.

It can help mitigate risk associated with working outdoors, and can safeguard your family’s financial future.

Besides covering accidents, this policy also covers funeral and repatriation expenses — ensuring your family has one less thing to worry about when the time comes. Covers funeral expenses due to accident subject to maximum of USD 800.00 only.

Covers repatriation expenses due to accident (i.e. cost of transportation of mortal remains to the insured home) subject to maximum of USD 2,000.00 only.

Product highlights…...

Golden Protection is Personal Accident insurance or PA insurance which provides compensation in the event of disability or death caused solely by violent, accidental, external and visible events.

This plan provides 24-hour worldwide and protecting you anywhere in the world, any time of the day.

Golden Protection offers you:

- Pays a cash sum up to USD 40,000 in the event of accidental death;

- Pays a cash sum up to USD 40,000 in the event of permanent disablement due to accident;

- Covers funeral expenses cause by accident up to USD 800; and

- Covers repatriation expenses due to accident (cost of all necessary arrangement including but not limited to transportation of mortal remains, undertaker, casket, embalming and/or cremation) up to USD 2,000.

How it work……

Understanding our policy is simple. That’s because, we have simple, and clear plans. Here is how it works:

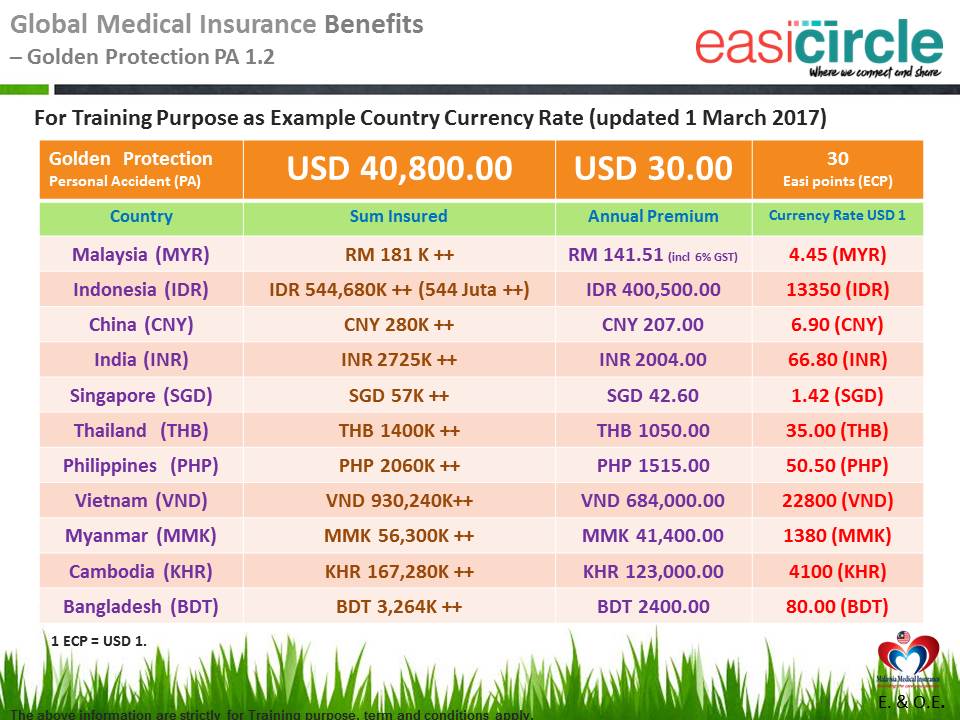

You pay USD 30 or Ringgit Malaysia equivalent (RM 133.50) per year, and you will gain:

i. Up to USD 40,000 in the event of accidental death or permanent disablement.

ii. Cash benefit of USD 800 for the funeral expenses

iii. Repatriation expenses due to accident (transportation of mortal remains to the insured home) up to USD 2,000

ix. Peace of mind knowing that your family is protected financially during times of uncertainty

x. Confidence knowing that you can plan for your family’s future

In addition, below are the other types of benefits included in the Golden Protection policy for your kind perusal.

Total Permanent Disablement Benefits

|

Description of Disablement |

According to percentage below |

|

Loss of two (2) Limbs |

100% |

|

Loss of both hands, or of all fingers and both thumbs |

100% |

|

Total and irrecoverable loss of both eyes (whole eye and sight) |

100% |

|

Loss of One hand and one foot |

100% |

|

Loss of One foot and sight of one eye |

100% |

|

Total paralysis |

100% |

|

Injuries resulting in being permanently bed ridden |

100% |

|

Any other injury causing permanent total disablement |

100% |

|

Total and irrecoverable loss of eye (whole eye and sight) |

50% |

|

Loss of arm at shoulder |

50% |

|

Loss of arm between shoulder and elbow |

50% |

|

Loss of arm at elbow |

50% |

|

Loss of arm between elbow and wrist |

50% |

|

Loss of hand at wrist |

50% |

|

Loss of leg (at hip, between knee and hip and below knee) |

50% |

|

Loss of hearing both ears |

40% |

|

Loss of four (4) fingers and thumb on one (1) hand |

30% |

|

Loss of speech |

25% |

|

Loss of four (4) fingers |

20% |

Just like most things for sale on the internet with their terms and conditions applied, our policy is no different. We suggest that you read the Term & Conditions carefully in order to know the full term of your coverage.

Who Should Apply…….

Golden Protection is offered to individuals aged between 19 to 70 on their next birthday and not travel with motorcycles while on duty, must be in normal heath and free from any physical deformity. Standard terms and conditions apply.

This type of insurance is suitable if you're employed or self-employed and want to protect your earnings or if you want to have additional financial protection in the event of an accident.

Those who are involved in the following occupations shall be covered during off-duty only;

- Police, army / military and law enforcement officers

- Aircraft testers, pilots or crew

- Divers

- Racing drivers

- Jockeys

- Persons engaged in professional sports activities

- Persons engaged in underground mining and tunnelling

- Firemen

- Seamen and sea fishermen

- War correspondents

- Oil rig workers

- Steeplejacks

- Stevedores

- Persons engaged in ambulance services

- Sawyers, timber logging workers, drivers/attendants of timber lorries and winches

- Wood working machinists or Using of wood-working machinery driven by mechanical power

- Explosive handlers

- Those who are required to travel on motorcycle while on duty.

Term and Condition…….

Our policy’s terms and conditions have implications for the way you are compensated, so it pays to understand them. They may look lengthy, but they are straightforward. Here they are:

- Golden Protection Personal Accident Insurance is available to individuals aged between 19 to 70 on their next birthday, must be in normal health and free from any physical deformity.

- This insurance plan excludes those who travel with motorcycles while on duty.

- It will not cover those who have lapsed their policy or stopped paying their premiums.

- Premiums paid are not refundable if you cancel your policy.

- This plan has a waiting period of seven (7) days. You will not be compensated if accident happened within seven (7) days from the date of your 1st policy issued.

- This insurance plan covers accident happened worldwide except Afghanistan, Cuba, Democratic Republic of Congo, Iran, Iraq, Liberia, Sudan or Syria.

- You won’t be compensated for any event directly or indirectly arising out of:

- War, civil war, invasion, insurrection, revolution, use of military power or usurpation of government or military power.

- Martial law or state of siege or any of the events or causes which determine the proclamation or maintenance of martial law or state of siege.

- Deliberately self-inflicted injury or suicide or the criminal or illegal act.

- Fits, hernia, illness of any kind venereal disease including those relating to the Acquired Immune Deficiency Syndrome (AIDS), pregnancy, childbirth, miscarriage, confinement or any complications thereof, intoxicating liquor, drugs or misuse of drugs prescribed by a legally qualified medical practitioner, suicide, self-inflicted injury, judicial pronouncement, unlawful act on the part of the Participant or wilful exposure of the Participant to unnecessary danger except in an attempt to save human life.

- While the insured is in a state of unsound mind, drugs overdosed, gas inhalation and/or suffocation, food and/or drink poisoning, provoked and/or unprovoked assault or murder, hijacking and/or disappearance.

- Any act of any person acting on behalf of or in connection with any organization with activities directed towards the overthrow by force of any de Jure or de facto Government or to the Influencing of it by terrorism or violence.

- While the Participant is using power-operated wood working machinery or engaging in Hunting, Trekking activity in any place with height more than four thousand (4,000) meters above sea level, Mountaineering, Steeple chasing, Polo, Racing of any kind, riding a two-wheel motorcycle, Water Skiing, Ice or Winter Sports of any kind, Scuba diving, Skin diving of any kind including the use of Aqua-lungs, Boxing, Wrestling and Training or performing any form of Martial Arts and all aerial sporting activities unless previous consent of the Operator has been obtained and the Certificate has been endorsed accordingly. In any event whatsoever any person engaging or participating in any sport on a professional basis, will not be covered under the Certificate.

- Participating in or training for any hazardous or dangerous sport or competition or riding or driving in any form of race or competition.

- Sickness, disease or any kind of infection however contracted, even if through injury and/or snake, insect and/or animal bite. This Exclusion however, does not apply to sickness or disease directly resulting from medical or surgical treatment rendered necessary by an injury or to infection directly resulting from an injury, provided that in each case the injury itself is covered by this policy.

- The insured person having a blood alcohol content over the prescribed legal limit when driving or operating any motor vehicle, and/or being under the influence of intoxicating liquor and/or being under the influence of any drug other than a drug taken or administered by, or in accordance with the advice of, a legally qualified medical practitioner.

- While the Participant is in on or ascending into or descending from any aircraft other than a fully licensed commercial passenger carrying aircraft in which the Participant is travelling as a passenger (on scheduled flights only) other than as a member of the crew and not for the purpose of undertaking any trade or technical operation therein or thereon.

- By or contributed by or arising from ionizing radiation or contamination by radioactivity from any nuclear fuel or from any nuclear waste from the combustion of nuclear fuel.

- By or arising out of or consequent upon or contributed to by HIV infection, Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC) howsoever this syndrome has been acquired or may be named.

- Any action caused or an injury inflicted by any person deriving benefit from this insurance policy or by any person conspiring with any person deriving benefit from this insurance policy.

- Any disability, abnormality or deformity which originated prior to the Inception Date of this insurance policy.

The full sample of policy document is available for your viewing. Please click on the Policy/Certificate folder to view.

How To Claim……...

To make a claim, the following documents are required:

- Accident Death Claim (to be submitted by trustee or executor or lawyer or next of kin)

- Completed Claim Form

- Certified NRIC/Passport (Life Assured & Claimant)

- Police Report/Accident Report (Original)

- Certified Death Certificate

- Certified Post Mortem

- Letter from Embassy in country of destination (original)

- Total & Permanent Disability (to be submitted by Insured unless medically incapacitated)

- Completed Claim Form

- Certified NRIC/Passport (Life Assured & Claimant)

- Police Report/Accident Report (Original)

- Medical Report (Original)

- Full length photograph (Life Assured)

Please click on the relevant claim form below to download.

Product Disclosure Sheet

https://www.easicircle.com/my/products/insurance-plan.aspx?PlanCode=ASICPA#pds

Sample Policy/Certificate

or

https://www.easicircle.com/my/products/insurance-plan.aspx?PlanCode=ASICPA#sample-policy

Shared By MMI

Malaysia Medical Insurance Organization (MMI)

Find out how to become our country region global insurance education center n mobile education advisor.

Find out how to become our pioneer regional leaders for the Asean 1st Global Online Insurance Program Biz n More 10 Billion USD production n earning income opportunities !!!!!

请按以下的链接,免费注册成为Easicirle会员资格可以理解更多电子全球保险E 时代保单,全球电子保险市场业务拓展分享。

注册须要准备好你的电子邮件,谢谢

按以下链接.....

MMI Services

pls follow below link to sign up FREE Easicirle membership for Global online insurance program details n understanding online insurance industry.

Pls ready ur email to sign up, tq

As per advice link.....

MMI Services

Invitation by

Anthony Chin

MMI Founder & Chairman

Malaysia Medical Insurance Organization (MMI)

+603-92863323

+6011-12239838 (Whatsapp, Line, Viber)