Comprehensive Personal Accident Insurance, Travel Insurance, Senior Gold PA Insurance Policy arranged by Malaysia Medical Insurance Organisation (MMI)

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Product description: AXA SmartCare VIP - Personal Accident Insurance Plan (PA)

With SmartCare VIP, you can create an immediate emergency fund to protect you and your family 24 hours a day, anywhere in the world.

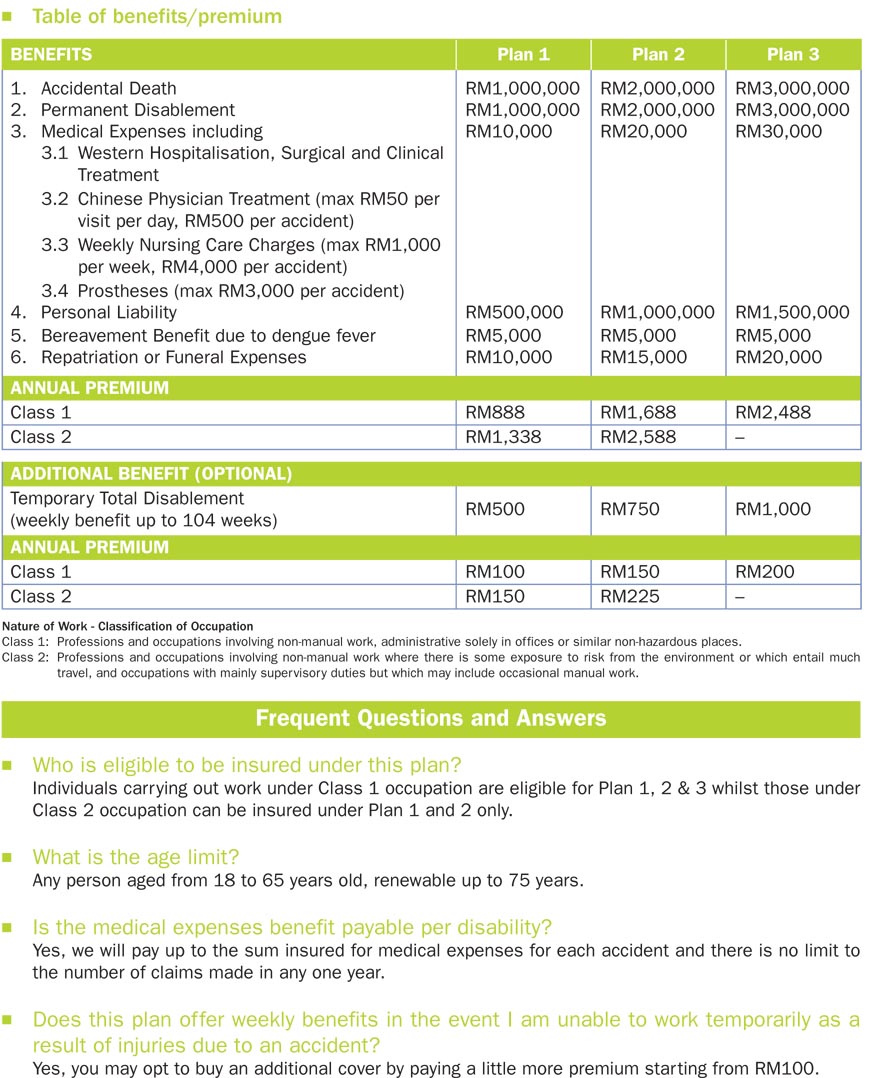

Ensure comprehensive coverage against accidental death, accidental permanent disablement, accidental medical expenses, personal liability, bereavement expenses for death due to dengue fever and repatriation or funeral expenses. With SmartCare VIP, you can create an immediate emergency fund to protect you and your family 24 hours a day, anywhere in the world.

This plan also pays for prostheses as well as crutches and wheelchairs, and post-hospitalization

SmartCare VIP gives you the option of receiving weekly payments if you are unable to attend to your

usual occupation as a result of an accident. Table of benefits

Nature of Work - Classification of Occupation

Class 1: Professions and occupations involving non-manual, administrative solely in offices or similar non-hazardous places. Class 2: Professions and occupations involving non-manual work where there is some exposure to risk

AXA Affin General Insurance Berhad is a joint venture between AXA Group and Affin Holdings Berhad, a leader in Malaysia’s financial services industry. We were incorporated in Malaysia on July 12th, 1975 as a licensed general insurance company. Prior to that, companies that now form part of the AXA Group operated in Malaysia for a period stretching back to 1874. AXA Affin has been focusing on growth in Malaysia and is one of the most profitable in the insurance industry. We employ about 700 people in 21 offices all over Malaysia, and service more than 300,000 customers through nearly 3000 agents.

With over 130 years of experience in Malaysia, we have expertise in personal, business and health insurances. Our product range includes Motor, Household, Health, Accidental and Travel Insurance for individual customers as well as comprehensive plans specially designed for SME businesses. In addition, we provide insurance services in specialist fields such as Marine and Trade Credit Insurance. Our Commitment We strive to become the preferred company by conducting our business responsibly and building long-term relationships of trust with our customers and partners. Three core attitudes that guide our daily actions and our commitment: Available: We are there when our customers need us and we listen to them, truly. Attentive: We treat our customers with empathy and consideration, provide personalized advice along their lives and reward their loyalty. Reliable: We say what we do and we do what we say, we deliver and keep our customers informed, so that they can trust us. Member of PIDM AXA Affin General Insurance Berhad is a member of Perbadanan Insurans Deposit Malaysia (PIDM). As a member of PIDM, some of the benefits insured under the takaful certificates or insurance policies offered by AXA Affin General Insurance Berhad are protected against loss of part or all of takaful or insurance benefits by PIDM, in the unlikely event of an insurer member failure. For further details of protection limits and the scope of coverage, please obtain a PIDM information brochure from AXA Affin General Insurance Berhad or visit PIDM website (www.pidm.gov.my) or call PIDM toll free line (1-800-88-1266). Malaysia Medical Insurance Organization (MMI)

Your Trusted and Experience Malaysia Largest Risk Management Medical and Health Insurance Solution Advisory Organization.

Malaysia Medical Insurance Organization (MMI) Head Office, 158-3-7, BLOK 158, KOMPLEKS MALURI,

JALAN JEJAKA, TAMAN MALURI,CHERAS, 55100 KUALA LUMPUR, MALAYSIA.

MMI careline +603-92863323

mmicare@medicalinsurance.com.my

www.medicalinsurance.com.my

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AXA SmartCare VIP Personal Accident -AXA SmartCare VIP Personal Accident | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Product Reviews: [Add Review] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Back

Back