MMI Organization

Advance Info, link and Support

Buy Online For Dengue Medical Income Insurance Plan

MMI Global Education Center Lisiting

Global Medical Insurance powered by Easicirle

Global Online Insurance Program powered by Easicirle MMI Facebook Page

Global Online Insurance Program Powered By Easicirle MMI Facebook Page

https://www.facebook.com/globalonlineinsurance/

Global Online Insurance Program

FREE VIEW, FREE Membership

No Hidden T&C

Follow this Link

MMI Corporate Video

Online medical insurance marketing support

Malaysia medical insurance advice support

Malaysia Panel Private Hospitals

Online Medical Assistance Support Info

Second medical opinion assist services Info

Malaysia prevention and wellness program

MMI Customer Service Careline

Medical Insurance Advance Training

Online Download Support

Reward and redemption loyalty program

MMI Nationwide Strategic Network

Comprehensive Personal Accident Insurance, Travel Insurance, Senior Gold PA Insurance Policy arranged by Malaysia Medical Insurance Organisation (MMI)

| |||||||||||||||

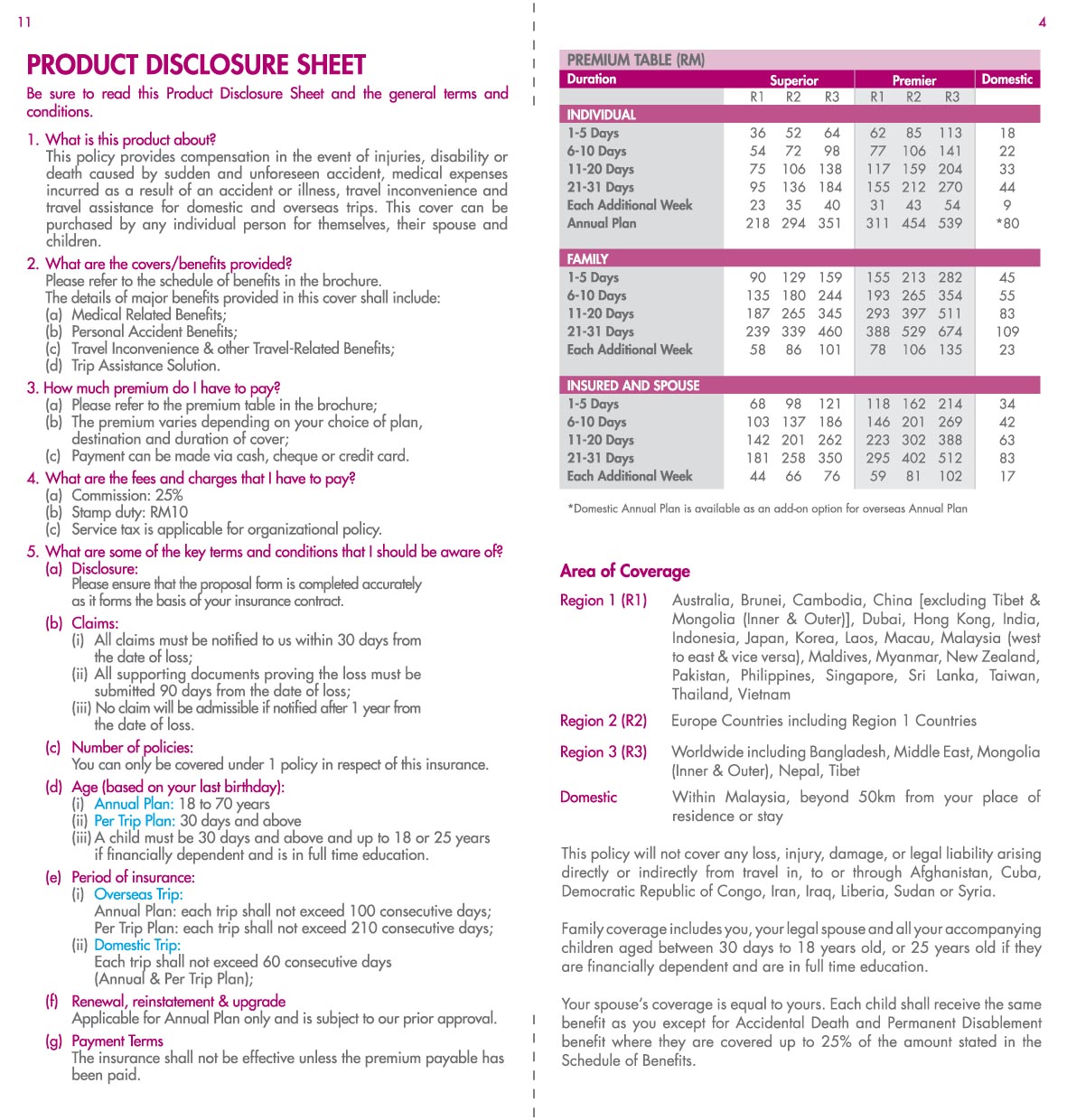

| Product description: AIG Travel Insurance Worldwide Travelling Cash Less Medical Card Insurance Plan

AIG Travel Insurance

- Worldwide Travel Medical Card with Cash Less Hospital Admission Assistance Program Coverage Insurance Plan

Annual Plan for AIG Worldwide Travel Medical Card with Cash Less Hospital Admission Program as below

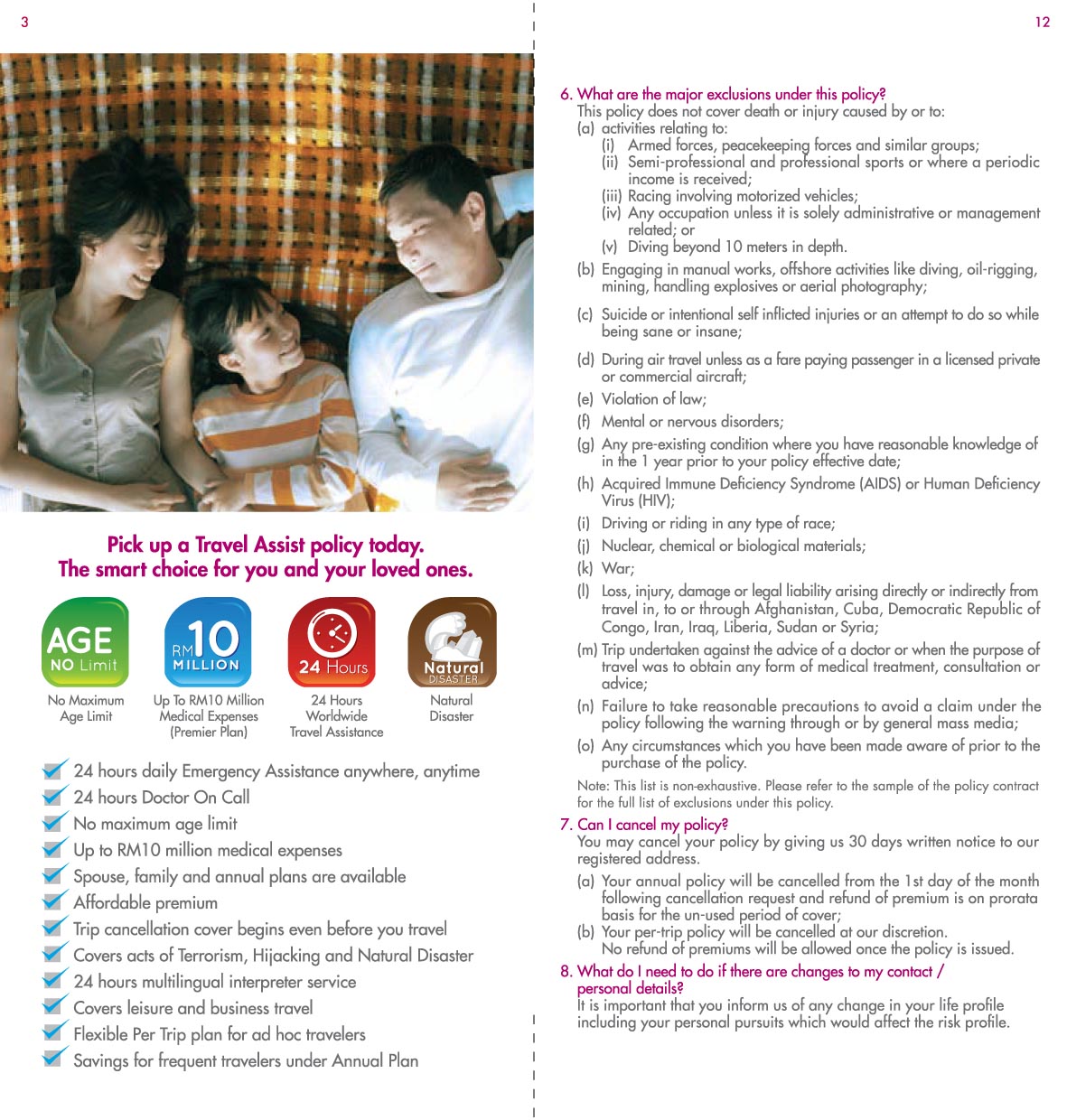

Premier Plan ( Annual Plan - 12 months period of coverage)

Annual plan – 100 consecutive days for an overseas trip.

Travelling to multiple destinations within the same trip, you can be covered under one policy.

AIG Travel Assist Medical Card is a comprehensive worldwide travel medical card with cash less hospital admission benefits insurance plan for overseas travel or business trip.

Major benefits provided are medical related benefits, personal accidents benefits, travel inconvenience & other travel-related benefits and 24 hours worldwide travel with emergency hospital admission cash less system assistance.

Sum Insured and Benefits Coverage (Coverage only for Departs Malaysia)

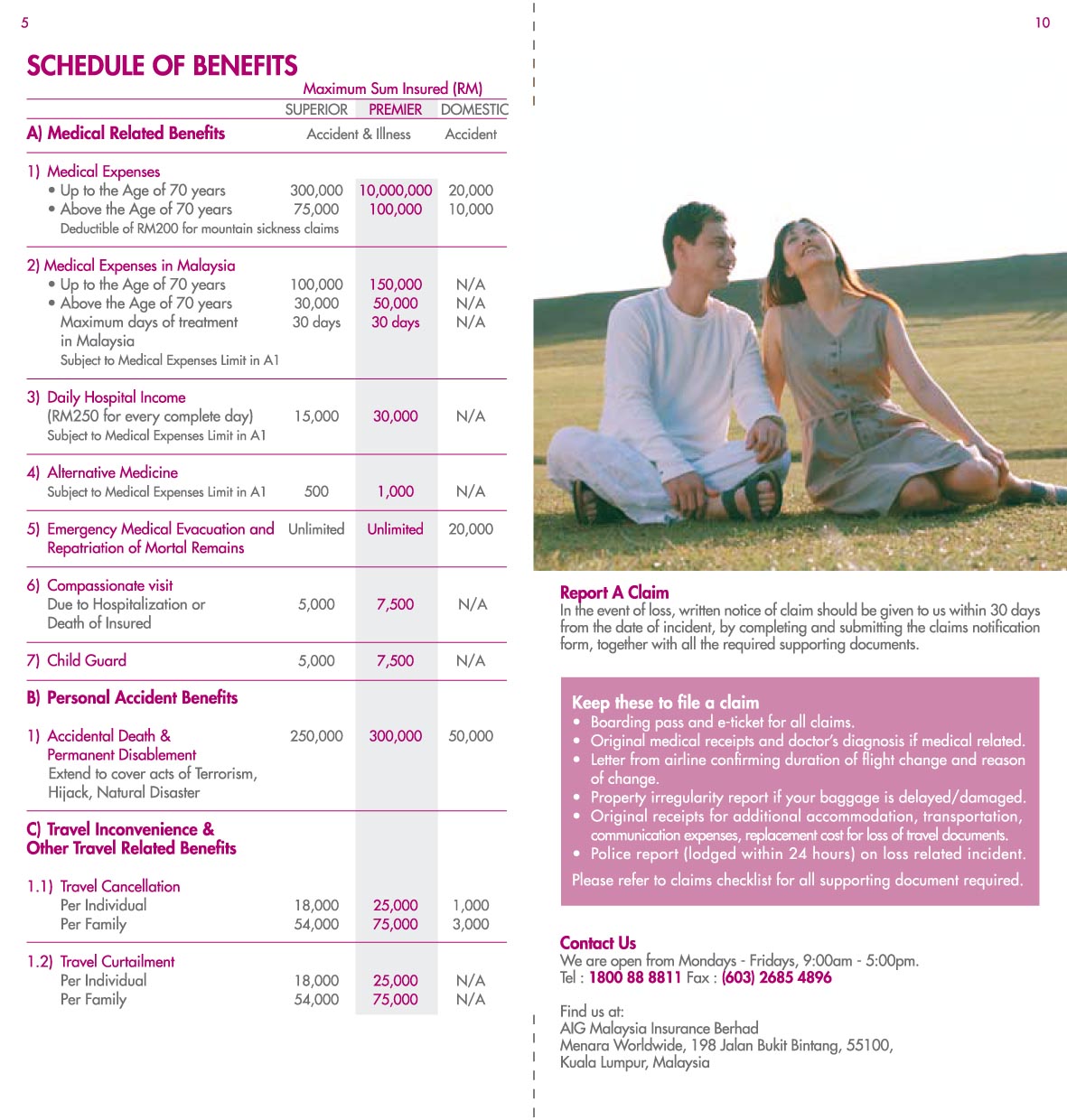

A Medical Related Benefits

01) Medical Expenses - RM 10,000,000.00 (RM10 million)

A) Compassionate visit - up to max RM 7,500.00 (Due to Hospitalization more than 5 days or Death of Insured)

B) Child Guard - up to max RM 7,500.00 (Covered expenses incurred to accompany your child back to Malaysia If insured are hospitalized and there is no one took after your child.

02) Daily Hospital Income - RM 250 per day and up to max RM 30,000.00 per disability. 03) Emergency Medical Evacuation and Repatriation of Mortal Remains - RM Unlimited.

Sum insured or Benefits listed in the schedule of benefit is payable based on per incident. B Personal Accident Benefits

04) Accident Death or Permanent Disablement - RM 300,000.00.

C Travel Inconvenience and Others Travel Related Benefits

05) Travel Cancellation - RM 25,000.00

06) Travel Curtailment - RM 25,000.00

07) Travel Delay - Common Carrier - up to max RM 3,600.00 (RM 150 / every 6 consecutive hours of delay)

08) Travel Delay - Chartered Flight - up to max RM 1,200.00 (RM150 / every 10 consecutive hours of delay)

09) Travel Re-route, Travel Overbooked, Travel Misconnection, Missed Departure - RM 1,200.00 (RM 200 / every 6 consecutive hours of delay)

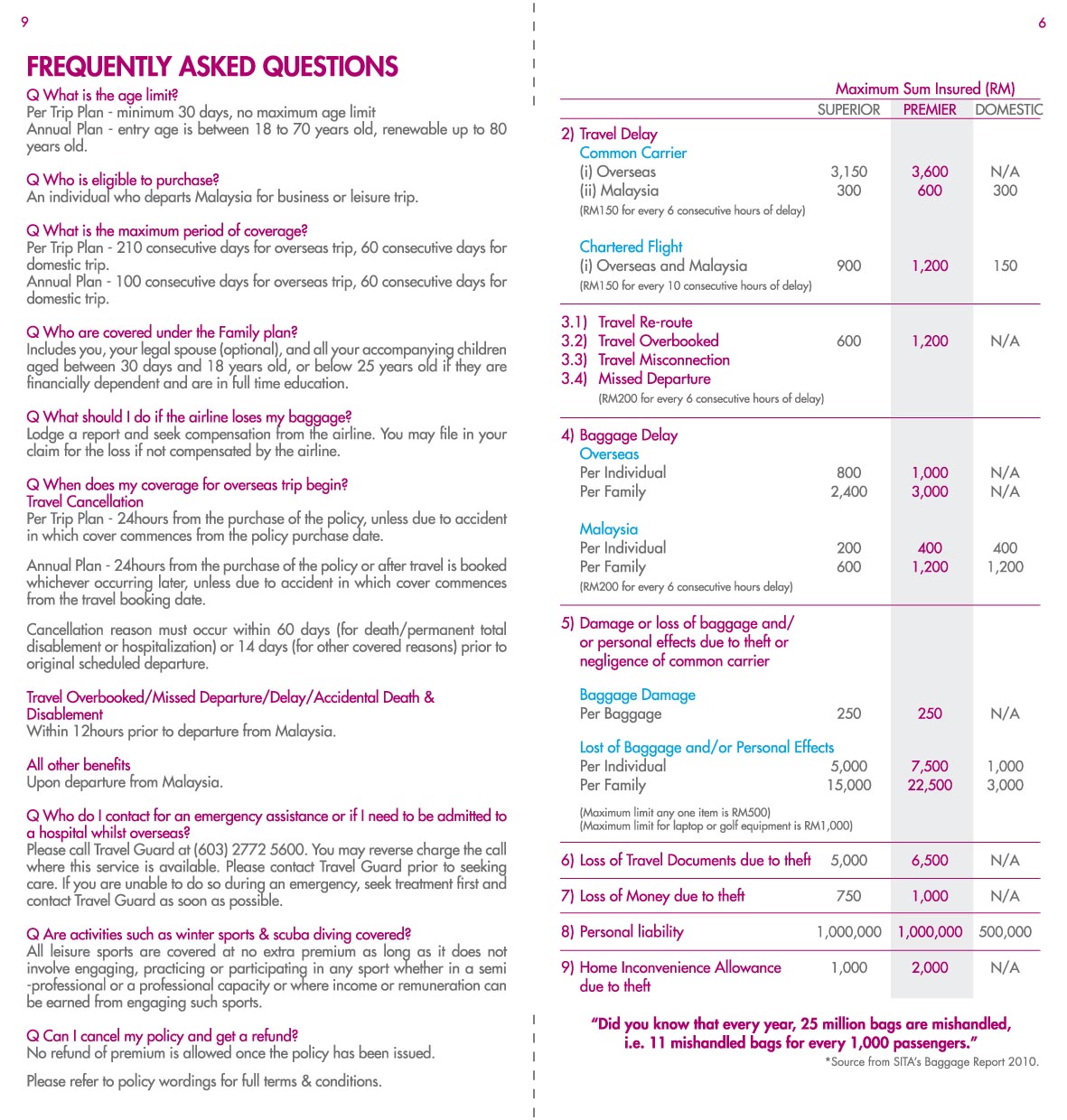

10) Baggage Delay - RM 1,000.00 (RM 200 / every 6 consecutive hours of delay)

11) Damage or loss of baggage and / or personal effects due to theft or negligence of common carrier -

A) Baggage Damage - RM 250 per baggage

B) Loss of Baggage and/ or Personal Effects - up to max RM 7,500.00 (Max limit RM 500.00 per items, Laptop or golf equipment is RM 1,000.00)

12) Loss of Travel Documents due to theft - up to max RM 7,500.00.

13) Loss of Money due to Theft - up to max RM 1,000.00.

14) Personal Liability - up to max RM 1,000,000.00.

15) Home Inconvenience Allowance due to theft - RM 2,000.00

16) Compassionate visit - up to max RM 7,500.00 (Due to Hospitalization more than 5 days or Death of Insured)

Sum insured or Benefits listed in the schedule of benefit is payable based on per incident.

D Trip Assistance Solution (Included)

1) 24 hours Worldwide Travel Assistance.

2) Doctor or Physician On Call.

3) World Event Alert Services.

4) Global Weather.

5) Emergency Travel Services.

6) Emergency Language Interpreter

7) Ambassador Services

8) Global Cash

All above mention of coverage and benefits should refer to policy wordings for full terms and conditions.

Coverage for overseas trip begin

Annual plan - 24hours from the purchase of the policy or after travel is booked whichever occurring later, unless due to accident in which cover commences from the travel booking date

Cancellation reason must occur within 60 days (for death/permanent total disablement or hospitalization) or 14 days (for other covered reasons) prior to original scheduled departure.

Travel Overbooked/Missed Departure/Delay/Accidental Death & Disablement

Within 12hours prior to departure from Malaysia All other benefits upon departure from Malaysia Annual Premium and Coverage Countries

Region 1

Asia Country including Australia, New Zealand, Myanmar, Pakistan, Dubai except Bangladesh, Nepal, Tibet, Mongolia (Inner & Outer), Middle East.

Annual Premium - RM 322.00 (Included RM 10.00 Stamp Duty) Region 2 (Europe Country including Region 1 countries).

Annual Premium - RM 464.00 (Included RM 10.00 Stamp Duty)

Region 3 (Worldwide including Bangladesh, Nepal, Tibet, Mongolia (Inner & Outer), Middle East.

Annual Premium - RM 549.00 (Included RM 10.00 Stamp Duty)

This policy Not cover for any travels made in, to or through Afghanistan, Cuba, Democratic Republic or Congo, Iran, Iraq, Liberia, Sudan or Syria.

FAQ - Annual Plan 01) If We need an emergency assistance or if We need to be admitted to a hospital whilst overseas?

Please call AIG Travel Guard at 603 2772 5600. You may reverse charge the call where this service is available. Please contact Travel Guard prior to seeking care. If you are unable to do so during an emergency, seek treatment first, and contact Travel Guard as soon as possible.

02) Are activities such as winter sports & scuba diving covered?

All leisure sports are covered at no extra premium as long as it does not involve engaging, practicing or participating in any sport whether in a semi professional or in a professional capacity or where income or remuneration can be earned from engaging in such sports. 03) Can I cancel my policy and get a refund?

No refund of premium is allowed once the policy has been issued. 04) How do I submit a claim?

Please submit a duly completed travel claim form within 30days from the date of loss, together with all supporting documents and contact ACPG +603-92863323 or email to enquiry@acpgconsultant.com. 05) How long does it take to process a claim?

30 working days upon receiving complete document, and provided that there is no further information or investigation required 06) What should I do if the airline loss my baggage?

Lodge a report and seek compensation from the airline. You may file in your claim for the loss not compensated by the airline 07) Will I be covered for an illness that I am already suffering from or have suffered in the Past?

No. We do not cover any pre-existing condition within 1 year prior to the policy effective date. 08) Can I continue my medical treatment in Malaysia for injuries sustained overseas?

Yes. If you suffer from a disability while on an overseas trip and then seek follow-up treatment in Malaysia, we will reimburse the medically necessary expenses incurred within 30 days upon arrival to Malaysia, subject to medical expenses limit specified in the schedule of benefit. 09) If I fall down overseas but did not seek treatment overseas, can I claim for medical expenses if I seek treatment after returning to Malaysia?

Yes. If no treatment is sought overseas, you must sought first treatment within 24 hours from the date of arrival in Malaysia. We will reimburse the medically necessary expenses incurred within 30 days upon arrival to Malaysia, subject to medical expenses limit specified in the schedule of benefit. 10) Are dental expenses or pregnancy-related matters covered?

No. Dental expenses and pregnancy-related matters are not covered, unless they are direct consequences of an accident. 11) I need to cut-short my trip because my father is hospitalized in Malaysia. What am I covered for?

We will reimburse the reasonable and necessary additional cost of travel and accommodation up to RM 1,000 and the unused and non-refundable expenses which is paid in advance and not recoverable from any sources. 12) Can I file a claim if my baggage is stolen as I left it outside on a bench while I am checking In?

No, we do not cover for loss of baggage left unattended in any public place, as the policy excludes any failure of the insured to take reasonable efforts to safeguard his/her property. 13) Can I claim for travel cancellation if I cancel my trip because of political unrest at my planned destination?

Yes, travel cancellation covers any event below which occurs within 14 days prior to original scheduled departure. · Event which leads to widespread violence · Event which put your life in danger · Event which with the advise of the government declaring unsafe conditions for travel However, the policy excluded strike or events due act of war, assertion of sovereignty, insurrection, revolution and use of military power. 14) What should I do if I lose money whilst aboard?

You must report to local police within 24 hours after the incident. Please submit a police report (in English translation) in the events of claims, together with proof of travel and completed claims form. 15) Will I be covered if my belongings are pick-pocketed while traveling overseas? Yes. You must report to local police within 24 hours after the incident. Please submit a police report (in English translation) in the events of claims, together with original purchase receipt and completed claims form. 16) Does Travel Assist cover for Natural Disaster? Yes. We cover Travel Cancellation, Travel Curtailment, Travel Delay, Medical Expenses reimbursement and Accidental Death or Permanent Disablement due to Natural Disaster. 17) If I transit in Middle East (region 3) during my trip to Europe (region 2) but I am not stopping over in Middle East, what region should I buy?

If you transit in Middle East with no stopover, you may purchase a region 2 plan. If you transit in Middle East with maximum stopover of 1 night because there is no connecting flight, You may also purchase a region 2 plan. 18) Can I extend my policy period after my trip commence? Coverage shall be extended at our discretion for up to 30 days from the expiry of the period of insurance without payment of any additional premium if you are hospitalized and/or quarantined overseas as recommended by a doctor or any other circumstances beyond your control which is deemed reasonable by us prohibiting your return to Malaysia prior to the insurance expiry. All above mention of coverage and benefits should refer to policy wordings for full terms and conditions.

Even the best-planned holiday can be you need? affected by the unexpected. Why expose yourself when travel insurance can give you the cover. | |||||||||||||||

| |||||||||||||||

| AIG Travel Insurance-AIG Travel Insurance Worldwide Travelling Cash Less Medical Card Insurance Plan | |||||||||||||||

| Product Reviews: [Add Review] | |||||||||||||||

Back

Back